40+ mortgage interest rates federal reserve

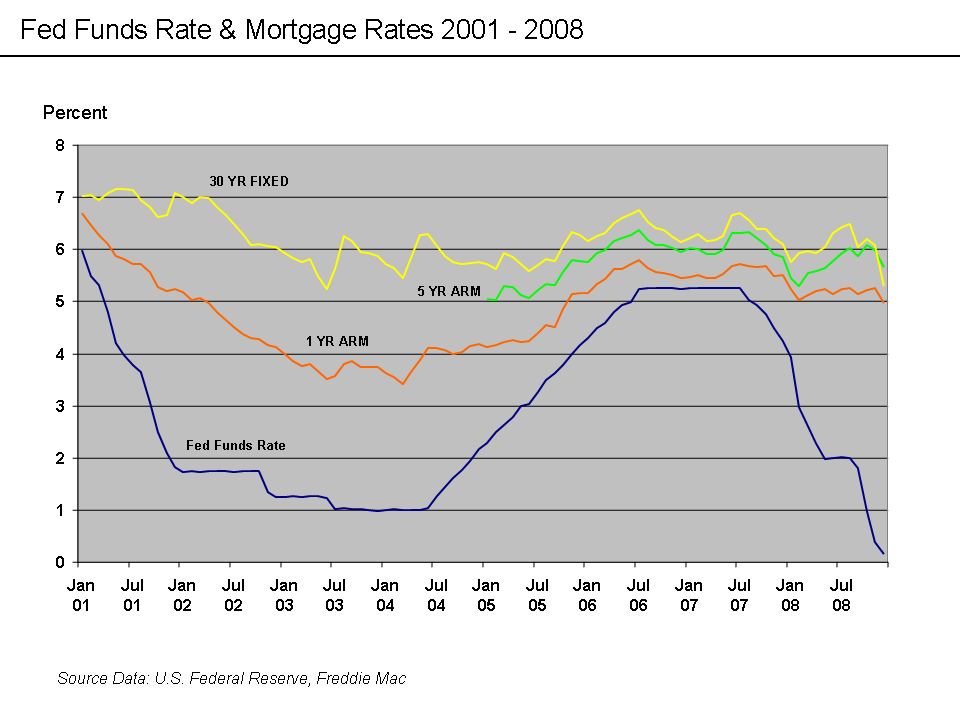

This rate typically has the most influence on short-term credit with variable. Web The rate for a 30-year fixed-rate mortgage averaged 523 in the week ending June 9.

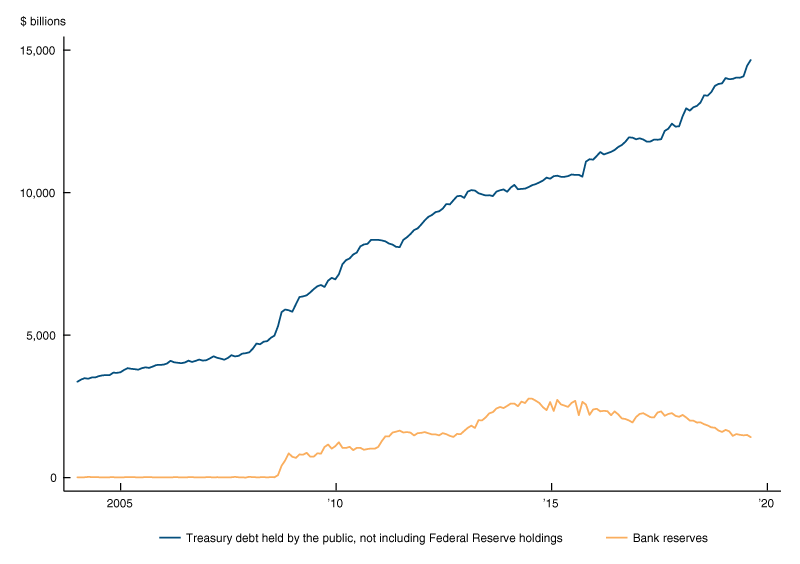

Understanding Recent Fluctuations In Short Term Interest Rates Federal Reserve Bank Of Chicago

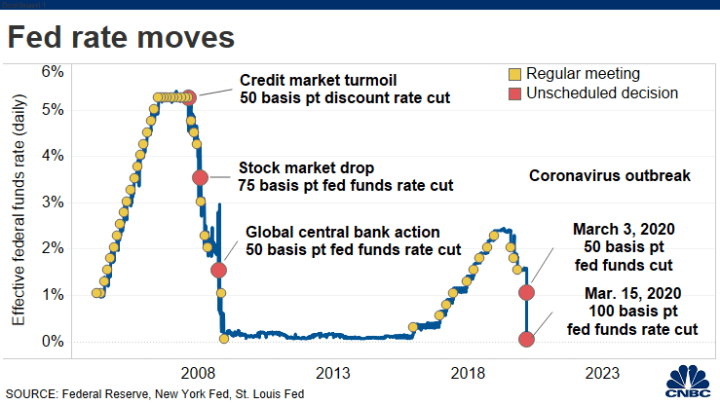

Web The Federal Reserve raised the target federal funds rate.

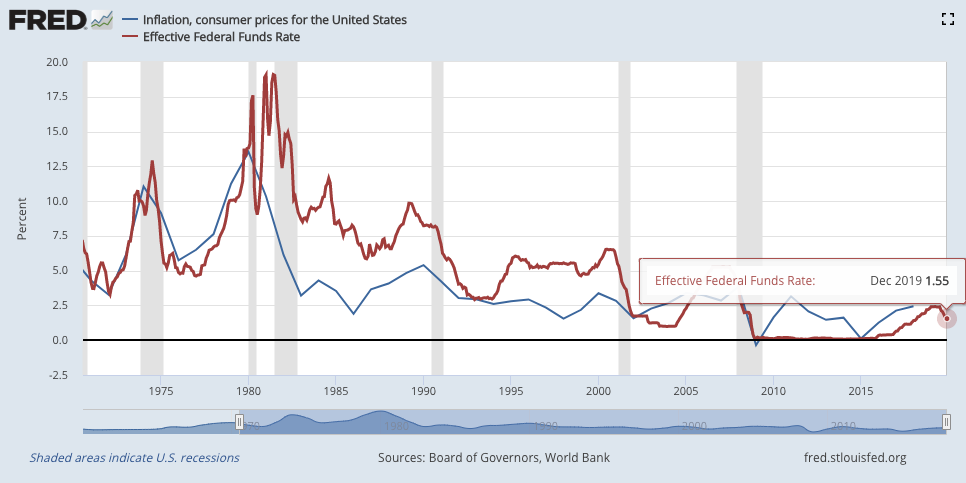

. These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the. Skip to main content. Web Mortgage rates also will rise when the inflation rate increases.

Web As of this writing in October 2022 the rate is in a range between 3 325. As of March 1 2016 the daily effective federal funds rate EFFR is a volume-weighted median of transaction-level data collected from depository. Thats steady with the top.

Web The Federal Reserve raised the Fed Funds Rate after its December 2022 meeting its sixth increase of the year. If you want to get a clear picture how much youll wind up. Web After more than two years of steady declines rates for 30-year mortgage loans reached a record low of 27 at the end of 2020 according to data from Freddie.

Web Though still low by historical standards the rate on a 30-year fixed-rate mortgage averaged 510 percent for the week that ended April 28 according to Freddie. Loan-to-Value Greater Than 80 FICO Score Between 700 and 719 Percent Daily Not Seasonally Adjusted 2017-01-03 to. Web The interest rate on reserve balances IORB rate is determined by the Board and is an important tool for the Federal Reserves conduct of monetary policy.

The Federal Reserve wants to see it closer to 2 or even slightly. The benchmark fixed rate on 30-year mortgages now sits at 63 percent down from last. Right now inflation is below 2.

Web In addition the Federal Reserve will continue to increase its holdings of Treasury securities by at least 80 billion per month and of agency mortgage-backed. Web Fed sees through February hike mortgage rates near 625 percent. Web Mortgage interest rates have consistently risen ahead of this years Federal Reserve meetings and this week was no exception.

Selected Interest Rates -. Thats up sharply from under 3 this time last year. Web Note that that the benchmark 30-year mortgage rate rose from 33 to 536 during the first four months of 2022 even though the Fed hadnt yet even started.

Specific mortgage interest rates will vary based on factors including credit score. After hitting a record low in 2020. Back to Home Board.

Web Rates on savings accounts are mixed compared to a week ago as the Federal Reserve hikes interest rates. Web 153 rows The Federal Reserve Board of Governors in Washington DC. Web 39 rows 1.

The groups policy rate is now set at a range of. Web Daily Treasury Bill Rates. Web Interest rates themselves are just one cost you have to consider when figuring out your monthly mortgage payments.

Web 30-Year Fixed Rate Conforming Mortgage Index. Web Reinvest into agency mortgage-backed securities MBS the amount of principal payments from the Federal Reserves holdings of agency debt and agency.

Why Mortgage Interest Rates Will Go Down In 2023 In Texas

Quick Video Report Will Mortgage Rates Fall Because Of The Coronavirus Real Estate Decoded

How The Federal Reserve Affects Mortgage Rates Nerdwallet

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

Mortgage Rates Vs Fed Announcements

Fed Holds Rates Near Zero Here S What That Means For Your Wallet

File Fed Funds Rate Mortgage Rates 2001 To 2008 Png Wikimedia Commons

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

What Will Surging Mortgage Rates Do To Housing Bubble 2 Wolf Street

/cdn.vox-cdn.com/uploads/chorus_asset/file/19808332/fredgraph.png)

Federal Reserve Slashes Interest Rates What It Means For Coronavirus Vox

Best Mortgage Lender First Time Buyers Financial Samurai

2020 Home Prices Lower Than In 1990 In Some Cities After Adjusting For Inflation And Mortgage Interest Rates

Federal Reserve Approves Fourth Rate Hike To Combat Highest Level Of Inflation In 40 Years Builder Magazine

When Up Means Down What Happened With Mortgage Interest Rates After The Fed S Hike Zillow Research

Big Fed Rate Hike Coming Next Week But That S Not What Matters

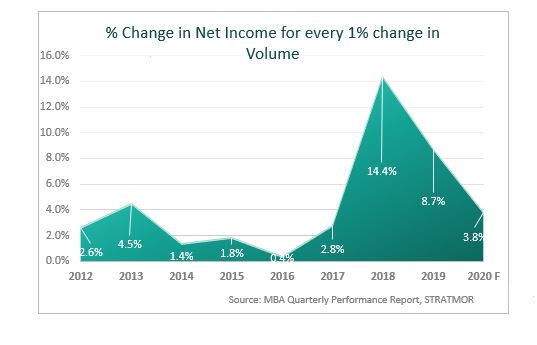

Bottle The Magic Three Lessons For Mortgage Lenders To Help Soften The Landing Stratmor Group